Mastering UK Tax Documentation with Expert Translation Services

Tax documents in the UK's complex legal system require specialized translation services to ensure accuracy for non-English speakers. These services are indispensable for precise translations of forms like Self Assessment, VAT returns, and Corpor…….

Tax documents in the UK's complex legal system require specialized translation services to ensure accuracy for non-English speakers. These services are indispensable for precise translations of forms like Self Assessment, VAT returns, and Corporation Tax submissions, which are laden with technical terminology and legal nuances. Professional translators with expertise in UK tax legislation offer clear and exact translations that prevent misinterpretation and financial risks. Their work facilitates effective communication with HM Revenue & Customs (HMRC) and supports compliance with UK tax obligations, avoiding potential penalties due to language barriers. By providing accurate translations, these services help individuals and businesses confidently navigate the UK tax system, ensuring legal requirements are met without ambiguity or error. The importance of these translation services is underscored by real-world scenarios where inaccurate translations led to financial complications and the aversion of penalties after corrections were made. In the context of international business, precise translations are not just beneficial but essential for transparent dealings, securing investment, and upholding the integrity of cross-border transactions.

Navigating the complexities of UK tax forms can be daunting for non-native speakers. With intricate language and specific legal terminology, these documents pose significant challenges. This article elucidates the critical role of professional translation services in ensuring accuracy and compliance within UK tax documentation. We will explore the necessity of precise translations, common forms and their importance, linguistic hurdles faced by translators, and how to select the most suitable service for your tax document needs. Through case studies, we’ll demonstrate the tangible benefits of expert translations in the UK tax domain, highlighting their profound impact on businesses’ operations and legal standing.

- Understanding the Necessity of Accurate Translation for UK Tax Forms

- The Role of Professional Translation Services in Navigating UK Tax Documentation

- Common UK Tax Forms and Their Importance in Compliance and Reporting

- Linguistic Challenges in Translating UK Tax Forms and How Professionals Overcome Them

- Choosing the Right Translation Service for Your UK Tax Documentation Needs

- Case Studies: Successful Translation of UK Tax Documents and Its Impact on Businesses

Understanding the Necessity of Accurate Translation for UK Tax Forms

Navigating the complexities of UK tax legislation requires precise understanding and compliance. For individuals and businesses whose primary language is not English, this presents a significant barrier. Here, the role of professional translation services becomes pivotal. Accurate translations of tax documents from and into UK languages are essential for non-English speakers to fulfill their tax obligations correctly. The stakes are high, as misinterpretation or mistranslation can lead to legal complications, financial losses, or even penalties. Tax documents, including Self Assessment forms, VAT returns, and Corporation Tax submissions, contain nuanced terminology that requires specialized knowledge to translate effectively. Utilizing professional UK translation services ensures that every term, figure, and instruction is accurately conveyed, facilitating clear communication with HM Revenue & Customs (HMRC) and safeguarding against potential errors. This not only streamlines the tax submission process but also provides peace of mind for those who rely on these translations to meet their legal requirements in the UK.

The Role of Professional Translation Services in Navigating UK Tax Documentation

When non-UK residents or bilingual individuals encounter the intricate world of UK tax documentation, professional translation services become indispensable tools for navigating this complex landscape. The accuracy and precision of these services are paramount when translating tax documents from English to another language or vice versa. These documents often contain highly technical terminology and specific legal requirements that require a nuanced understanding of both the source and target languages. Professionals in this field are well-versed in the relevant tax legislation, ensuring that every term is translated correctly, without ambiguity, to prevent any misunderstandings or compliance issues. This is particularly crucial for tax documents, where errors can lead to significant financial implications. By providing clear, precise translations of UK tax forms and guidance, these translation services facilitate better communication with tax authorities, reduce the risk of misinterpretation, and enable individuals and businesses to meet their legal obligations accurately and efficiently. In doing so, they not only help in maintaining transparency but also contribute to the smooth functioning of cross-border transactions and international trade relations.

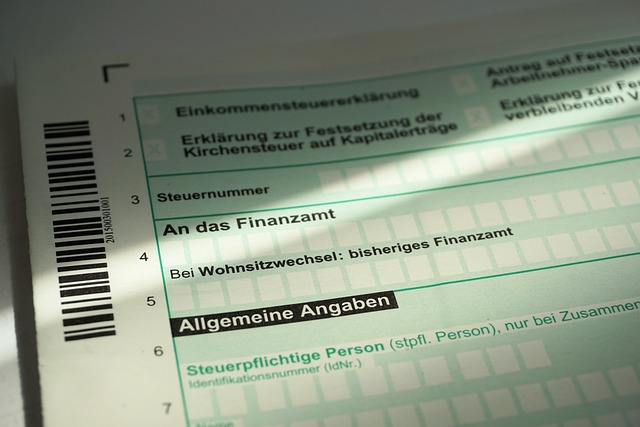

Common UK Tax Forms and Their Importance in Compliance and Reporting

When it comes to navigating the complexities of the UK tax system, understanding and accurately completing the necessary tax documents is paramount for both individuals and businesses alike. Common UK tax forms such as the Self Assessment (SA) tax return, form P11D for reporting company cars and benefits, and form CT600 for corporations tax, play a critical role in compliance and reporting obligations. For non-native English speakers or entities, the clarity of these documents can be further complicated by linguistic barriers. In such cases, professional UK translation services become indispensable tools to ensure that all information is accurately conveyed and that regulatory requirements are met without ambiguity. These services not only facilitate a clearer understanding of the tax documents but also help in avoiding potential penalties due to misinterpretation or errors arising from language differences. By leveraging these translation services, individuals and businesses can rest assured that their tax submissions are precise and compliant with UK tax laws, thereby upholding their legal and fiscal responsibilities effectively.

Linguistic Challenges in Translating UK Tax Forms and How Professionals Overcome Them

Navigating the complexities of tax documents in the UK requires not only a thorough understanding of UK tax laws but also linguistic proficiency. Tax forms are replete with technical terminology and specific legal jargon that can be challenging to convey accurately across languages. Professional translation services specialize in overcoming these linguistic barriers by employing experienced linguists who are fluent in both the source and target languages, as well as knowledgeable about UK tax regulations. These experts undergo rigorous training to handle tax documents with precision, ensuring that all nuances of the original text are preserved. They utilize advanced translation technology and meticulous editing processes to provide translations that are not only accurate but also compliant with legal standards. This is crucial as errors in translations can lead to misinterpretation by tax authorities or even penalties. By bridging language gaps, these services enable individuals and businesses to fulfill their tax obligations accurately and efficiently, regardless of the language of their primary documentation.

Choosing the Right Translation Service for Your UK Tax Documentation Needs

When the intricacies of UK tax documentation necessitate clear and precise translations, selecting the appropriate translation service is paramount. The accuracy of your tax documents can significantly influence the outcome of your tax obligations or any legal proceedings related to your finances in the UK. It’s crucial to opt for a professional UK translation service that specialises in legal and financial language to ensure the faithful rendition of your documents. These experts are adept at translating complex terminologies specific to UK tax law, which may be challenging for generalist translators. They possess not only linguistic expertise but also a thorough understanding of the UK’s fiscal regulations and the nuances inherent in tax documents. This specialized knowledge ensures that every figure, term, and statement is conveyed accurately, thereby maintaining compliance with both UK legal standards and your original document’s intent. By choosing a translation service with a proven track record in this field, you safeguard against potential miscommunications or errors that could lead to complications or delays in the tax process.

Case Studies: Successful Translation of UK Tax Documents and Its Impact on Businesses

Companies operating within the UK’s diverse business landscape often encounter the necessity for precise and accurate translations of tax documents to navigate legal requirements, particularly when engaging with international markets or employing non-native speakers. A case in point is the story of a multinational corporation that faced significant challenges due to discrepancies in translated tax forms. The initial translation contained errors that led to miscalculated tax liabilities and potential penalties. By leveraging professional UK translation services, the company retranslated their tax documents, ensuring every nuance of financial reporting was accurately conveyed. This resulted in a harmonious interaction with the HM Revenue & Customs (HMRC), avoiding costly fines and rectifying their tax position. Another instance involved a smaller business looking to expand internationally. The accurate translation of UK tax documents enabled them to present a clear financial picture to foreign investors, which ultimately facilitated the acquisition of much-needed capital for growth. These success stories underscore the critical role that professional translation services play in the UK’s business ecosystem, highlighting the importance of precise communication within the realm of taxation.