Mastering UK Tax Filings: The Role of Quality Translations

Professional Tax Document Translation Services are vital for individuals and businesses navigating UK tax filings, ensuring accuracy, compliance, and avoiding costly errors. These services, specializing in local regulations, provide clarity by accura…….

Professional Tax Document Translation Services are vital for individuals and businesses navigating UK tax filings, ensuring accuracy, compliance, and avoiding costly errors. These services, specializing in local regulations, provide clarity by accurately translating complex financial information, including nuanced tax terminology, from income statements to deductions. Key considerations include experience, certification, proficiency in UK tax laws, and availability of case studies demonstrating expertise. Engaging these professionals is essential for global businesses operating in the UK, enabling them to maintain meticulous records, facilitate audits, enhance reputation, and support better decision-making for a competitive edge.

In the intricate landscape of UK tax filings, clarity is paramount. Accurate translations of tax documents are not just beneficial; they are essential for compliance and business success. With complex regulations and a diverse language spectrum, ensuring precise translations can be challenging. This article explores the significance of professional UK tax translation services, offering insights on choosing the right provider and best practices to maintain clarity in tax filings. Discover how high-quality translations can revolutionise your business’s tax compliance journey.

- Understanding the Significance of Accurate Translations in UK Tax Filings

- Key Considerations When Choosing a Professional Translation Service for Tax Documents

- Best Practices for Ensuring Clarity and Compliance in Tax Document Translations

- The Impact of High-Quality UK Tax Translation Services on Business Success

Understanding the Significance of Accurate Translations in UK Tax Filings

Accurate translations play a pivotal role in ensuring clarity and compliance for individuals and businesses navigating UK tax filings. Tax documents, by their nature, are complex and often require precise terminology to convey financial information accurately. Using professional translation services for tax documents in the UK is not just beneficial but essential. It helps avoid misunderstandings, errors, or worst-case scenarios like audits or penalties due to incorrect translations.

Professional translators with expertise in tax terminology can capture nuanced meanings, ensuring that vital details are conveyed correctly across languages. This is especially crucial when dealing with international businesses or expatriates who need to file taxes in the UK while maintaining their primary language documentation. Reliable translation services offer peace of mind, guaranteeing that every element of your tax filing—from income statements to deductions—is represented accurately, thereby simplifying the process and reducing potential legal complications.

Key Considerations When Choosing a Professional Translation Service for Tax Documents

When selecting a professional translation service for tax documents in the UK, several crucial factors come into play. Firstly, ensure that the service provider has extensive experience and expertise in handling financial and legal documentation. Tax documents often involve complex terminology and specific regulations, so a well-versed translator is essential to avoid errors or misinterpretations. Look for translators who are qualified and certified in their field, preferably with a background in accounting or taxation.

Additionally, the ability to translate within the context of UK tax laws and regulations is vital. The translator should be familiar with the nuances and specific terminology used in British tax filings. This ensures that the translated document accurately conveys the same meaning and complies with local requirements. Reputable translation services will often provide samples or case studies showcasing their expertise, allowing you to gauge their capabilities before engaging their services.

Best Practices for Ensuring Clarity and Compliance in Tax Document Translations

When translating tax documents for the UK market, clarity and compliance are paramount. Engaging reputable tax document translation services specialised in local regulations is non-negotiable. These professionals not only bring expertise in language but also a deep understanding of UK tax laws, ensuring accuracy and consistency throughout the translation process.

Best practices include providing original documents in their native format, allowing translators to access all necessary information. Clear communication with translators about specific terminology used within the industry is crucial for maintaining conceptual accuracy. Regular reviews and quality checks by tax experts ensure that translated documents not only read fluently in English but also conform to UK tax regulations.

The Impact of High-Quality UK Tax Translation Services on Business Success

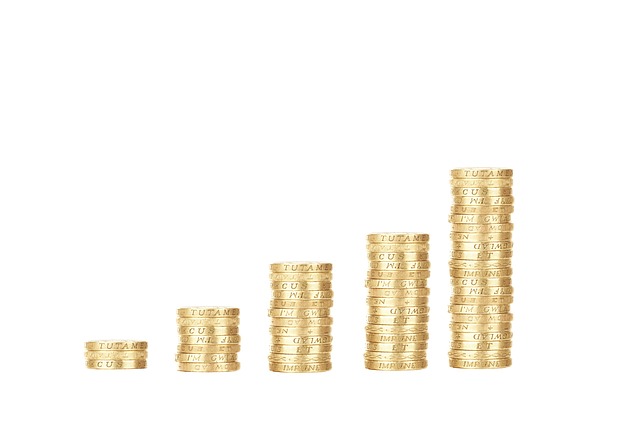

In today’s global business landscape, companies operating in the UK often need to navigate complex tax regulations and file documents in English. High-quality UK tax translation services play a pivotal role in ensuring compliance and promoting business success. Accurate translations of tax documents are essential as they convey critical financial information, legal obligations, and potential penalties or rewards. A professional translation service understands not just the language but also the nuances of tax terminology, minimising errors and miscommunications that could arise from machine-based translations.

By leveraging expert UK tax translation services, businesses can avoid costly mistakes, enhance their reputation for reliability, and foster stronger relationships with local authorities and international partners. These services enable companies to maintain meticulous records, facilitate smooth audits, and contribute to the overall efficiency of the tax filing process. Ultimately, clear and precise translations support better decision-making, strategic planning, and a competitive edge in the market, making them indispensable for any successful UK-based or UK-focused business.

In ensuring compliance and avoiding potential legal pitfalls, clarity in UK tax filings translations is paramount. By selecting professional translation services that specialize in tax documents, businesses can mitigate risks associated with inaccurate or vague interpretations. High-quality UK tax translation services not only simplify the filing process but also contribute to successful business outcomes by facilitating precise communication of financial information across language barriers.