Navigating UK Tax Compliance: A Guide to Tax Document Requirements and Expert Translation Services

Tax Documents UK translation services are indispensable for individuals and businesses operating across linguistic borders, ensuring that all tax-related documents are accurately translated to meet HM Revenue & Customs' standards. These spec…….

Tax Documents UK translation services are indispensable for individuals and businesses operating across linguistic borders, ensuring that all tax-related documents are accurately translated to meet HM Revenue & Customs' standards. These specialized services, provided by expert linguists well-versed in both the source and target languages and the intricacies of UK tax law, guarantee that financial terminology and complex legal requirements are conveyed with precision. This accuracy is crucial for compliance with UK tax regulations, which are known for their complexity, and for avoiding penalties or legal issues that can arise from misinterpretation of translated documents. By leveraging these services, businesses and individuals can confidently navigate the UK's multifaceted tax system, maintain transparent financial records, and fulfill their tax filing obligations accurately and on time.

Navigating the intricate web of UK tax regulations is a critical task for any business operating within its borders. This article demystifies the process, guiding readers through the necessary steps to ensure compliance with these complex laws. We will explore the scope of UK tax regulations, the importance of accurate tax documents, and the key documents required for UK tax filings. Understanding deadlines and timelines for submission is crucial, as is leveraging expert translation services to accurately convey information across languages. By outlining best practices and detailing how professional translation services ensure precise tax documentation, this article becomes an indispensable resource for maintaining HMRC regulations compliance. Whether you’re a multinational corporation or a small business owner, this guide will equip you with the knowledge to navigate UK tax laws with confidence.

- Understanding the Scope of UK Tax Regulations

- The Role of Tax Documents in UK Tax Compliance

- Key Tax Documents Required for UK Tax Filings

- Deadlines and Timelines for UK Tax Document Submission

- Navigating the Complexities of UK Tax Legislation with Expert Translation Services

- Essential Considerations for Tax Document Translation in the UK

- Best Practices for Maintaining Compliance with HMRC Regulations

- How Professional Translation Services Ensure Accurate Tax Documentation in the UK

Understanding the Scope of UK Tax Regulations

Navigating UK tax regulations requires a comprehensive understanding of their broad scope and application. Businesses and individuals alike must be cognizant of the various tax documents required under UK law, which include but are not limited to income tax returns, corporation tax returns, Value Added Tax (VAT) registrations, and self-assessment tax returns. These documents are critical for accurate tax calculations and compliance with Her Majesty Revenue and Customs (HMRC) standards. Non-UK residents who engage in commercial activities within the UK must also familiarize themselves with these requirements. In this context, Tax Documents UK translation services play a pivotal role in ensuring that all filings are accurately translated to comply with both the letter and spirit of UK tax law. Such services are essential for non-English speakers or businesses dealing with multilingual documentation, as precise translations can prevent misunderstandings or misinterpretations by tax authorities. This precision is key to avoiding penalties and ensuring that all parties have a clear understanding of their tax obligations under UK regulations. Understanding the scope of these regulations is not just about being aware of the documents; it’s about knowing how they fit into the larger tax framework and how they impact an individual or business’s fiscal responsibilities within the UK.

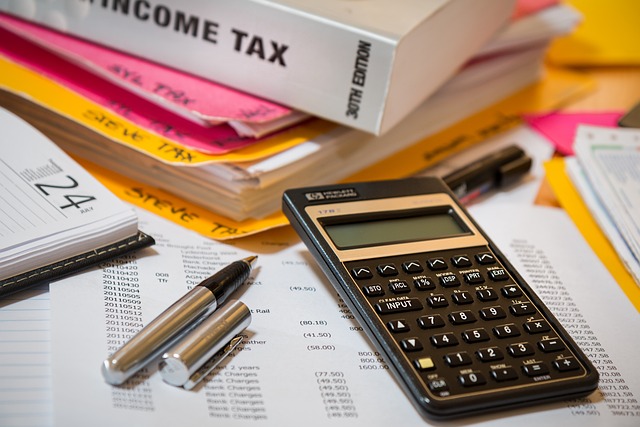

The Role of Tax Documents in UK Tax Compliance

In the United Kingdom, maintaining compliance with tax regulations is a multifaceted endeavour that hinges on the meticulous preparation and management of tax documents. These documents serve as the cornerstone for reporting income accurately, claiming allowances, and substantiating tax-deductible expenses. The HM Revenue & Customs (HMRC) mandates that all UK taxpayers keep detailed records and provide evidence for their tax filings. Tax documents, which include but are not limited to P60s, P45s, VAT returns, and self-assessment forms, must be complete and precise to avoid scrutiny or penalties. For businesses with international operations, the role of UK translation services becomes pivotal, as they ensure that financial records and tax documents are accurately translated for submission to the HMRC. This is crucial not only for compliance but also for protecting the integrity of financial reporting across different regions where English might not be the native language. The clarity and accuracy of these translations are paramount, as they directly affect the taxpayer’s legal obligations and can influence the outcome of tax audits or investigations. Thus, taxpayers are well-advised to engage with professional translation services that specialize in UK tax documents to navigate this complex aspect of tax compliance.

Key Tax Documents Required for UK Tax Filings

When managing tax obligations in the UK, it is imperative to maintain a comprehensive set of tax documents. These records not only facilitate accurate tax filings but also serve as evidence should HM Revenue and Customs (HMRC) conduct an investigation or audit. Key among these documents are the Self-Assessment Tax Return (SATR), which individuals must submit annually if they earn over a certain amount, or if they receive income from savings, investment, or rental properties. Additionally, businesses and self-employed individuals are required to keep detailed records of all sales and purchases, including VAT invoices and receipts, which are vital for Value Added Tax (VAT) returns. Companies House mandates the retention of these financial documents, including profit and loss accounts, balance sheets, and cash flow statements, for a minimum of six years. For entities with employees, P60 and P11D forms are essential, detailing employees’ earnings and any benefits provided. Furthermore, tax documents may occasionally require translation into English for compliance purposes, making UK translation services an invaluable resource for businesses with multilingual operations or foreign investments. It is crucial to stay abreast of the latest tax regulations and document requirements to ensure full compliance and avoid penalties. Utilizing professional UK translation services can help navigate language barriers associated with international tax documentation.

Deadlines and Timelines for UK Tax Document Submission

When managing tax obligations in the UK, adherence to deadlines and timelines for tax document submission is paramount. For individual taxpayers, the deadline for submitting online Self Assessment (SA) returns is typically set on the 31st of January following the end of the tax year, with payment of any due tax also due by this date. It’s crucial to maintain an organised record of financial transactions and income sources throughout the year to facilitate timely completion of these forms. Additionally, for companies, Corporation Tax returns must be filed within 12 months of the end of the accounting period, with the exact deadline varying depending on accounting reference periods.

In the context of UK tax documents, accuracy is as critical as adherence to deadlines. This is where UK translation services can play a pivotal role for businesses and individuals alike. Entities operating across borders or dealing with multilingual teams may encounter documents in various languages that require precise translation to ensure compliance and accurate tax filings. Utilising professional UK translation services not only guarantees the accuracy of translated documents but also aligns with the legal requirements set forth by Her Majesty’s Revenue & Customs (HMRC). This meticulous attention to detail and timely submission of tax documents can mitigate the risk of penalties and interest charges, ensuring that all obligations under UK tax regulations are fulfilled.

Navigating the Complexities of UK Tax Legislation with Expert Translation Services

Navigating the intricate web of UK tax legislation can be a daunting task for businesses operating across borders. The UK’s tax regime is notoriously complex, with a range of local, regional, and national taxes that must be accurately reported and filed. For foreign entities looking to do business in the UK, or UK-based firms dealing with international transactions, ensuring compliance is paramount. This is where expert translation services play a pivotal role. Professional translators who specialize in tax documents for the UK market can bridge the language gap, providing clarity and accuracy when it comes to translating financial records, tax returns, and other critical tax documentation. These specialists are adept at converting documents from one language to another while maintaining the integrity of the original content, which is crucial for legal and regulatory compliance. By leveraging the expertise of these translation services, businesses can mitigate the risks associated with linguistic barriers and ensure that their tax submissions meet all necessary UK regulations without the need for costly legal translations. This not only streamlines the process but also safeguards against potential misinterpretation or oversight that could result in penalties or legal complications. With the right translation support, businesses can confidently navigate the complexities of UK tax legislation and maintain their operational integrity within the British market.

Essential Considerations for Tax Document Translation in the UK

Navigating the complexities of UK tax regulations necessitates meticulous attention to detail, especially when it comes to translating tax documents for multinational entities or individuals who operate across borders. Utilising professional Tax Documents UK translation services is not just a legal requirement but also a strategic advantage. These services ensure that all financial terminology and nuances are accurately conveyed in the target language, thereby avoiding costly errors and ensuring compliance with HM Revenue & Customs (HMRC) standards. It is crucial to engage with translators who possess specialized knowledge of both the source and target languages, as well as a comprehensive understanding of UK tax legislation. This expertise guarantees that tax returns, financial statements, and other critical documents are translated with precision, reflecting all necessary information accurately and unambiguously. By leveraging reputable Tax Documents UK translation services, businesses can confidently navigate international transactions while remaining compliant with local regulations, thereby safeguarding their operations from legal complications and ensuring the integrity of their financial reporting.

Best Practices for Maintaining Compliance with HMRC Regulations

Businesses operating in the UK must navigate a complex web of tax regulations administered by Her Majesty’s Revenue and Customs (HMRC). To maintain compliance with these stringent requirements, it is imperative to adopt robust best practices. One key practice involves maintaining accurate and up-to-date tax documents, which reflect all financial transactions. These records should be easily accessible for HMRC review upon request. Additionally, companies must ensure that any necessary translations of tax documentation are precise and compliant with UK standards. Utilizing professional UK translation services can mitigate the risk of misinterpretation or errors in translated documents, thereby avoiding potential non-compliance penalties. For businesses with international operations, this is particularly crucial as it ensures that all financial information communicated to HMRC is clear and correct, regardless of the original language of the documents. Furthermore, staying abreast of the latest updates in tax laws, including changes in VAT, corporation tax, and income tax, is essential for ongoing compliance. Regularly consulting with tax professionals or using specialized tax software can provide valuable assistance in interpreting these regulations and implementing them effectively within a company’s financial operations. By prioritizing accuracy in tax documentation and staying informed about legal changes, businesses can significantly reduce the risk of tax discrepancies and maintain their compliance with HMRC regulations.

How Professional Translation Services Ensure Accurate Tax Documentation in the UK

Professional translation services play a pivotal role in ensuring that tax documents in the UK are accurately translated, aligning with the intricate legal and regulatory framework governing taxes. The UK’s tax landscape is complex, with specific terminologies and regulations unique to its jurisdiction. Translation agencies specializing in legal and financial documents employ expert linguists who not only possess a native-level command of the target language but are also well-versed in UK tax legislation. This dual expertise enables them to provide precise translations of tax documents, capturing all nuances and ensuring that the translated text conveys the exact intent as the original. The accuracy of such translations is paramount; it mitigates the risk of misinterpretation or non-compliance with UK tax laws, which could lead to penalties or legal complications for businesses and individuals alike. These services adhere to stringent quality assurance protocols, including peer review and the use of specialized translation memory software, to maintain the integrity of financial records and comply with the rigorous standards set by HM Revenue & Customs (HMRC). By leveraging these professional translation services, taxpayers in the UK can navigate the multilingual aspects of their fiscal obligations with confidence.

Navigating the intricacies of UK tax regulations is a complex task that demands meticulous attention to detail, particularly for entities operating under multiple jurisdictions. This article has illuminated the critical aspects of compliance, from the essential tax documents required for filings to the precise deadlines for submission. It underscores the significance of leveraging professional translation services to accurately convey financial information in compliance with HMRC standards. By adhering to best practices and utilising expert support, businesses can confidently meet their tax obligations within the UK framework. Ensuring clarity and precision in tax documents is not just a legal imperative but also a strategic advantage that fosters trust and reliability with regulatory bodies.