Navigating UK Tax Documents: A Guide to Professional Translation Services

UK businesses engaged in international trade must accurately translate their tax documents to comply with foreign legal and financial standards. Tax Documents UK translation services are indispensable for this task, providing certified translations t…….

UK businesses engaged in international trade must accurately translate their tax documents to comply with foreign legal and financial standards. Tax Documents UK translation services are indispensable for this task, providing certified translations that convey the precise numerical data and financial terminologies essential for cross-border transactions. These specialized services ensure that all nuances of UK tax legislation are correctly transferred into other languages, maintaining the intent of the original documents while adhering to cultural relevance and legal accuracy in the target language. With expert linguists who combine a deep understanding of both source and target languages with knowledge of accounting and legal jargon, these translation services enable businesses to navigate international markets seamlessly, facilitating effective communication with foreign tax authorities and stakeholders. By leveraging Tax Documents UK translation services, companies can ensure that their financial documentation is clear, accurate, and compliant, which is critical for successful international expansion and fostering trust with global partners.

Navigating the intricate details of UK tax documents is a pivotal task for businesses operating within or expanding to the United Kingdom. As global commerce thrives, the necessity for precise and professional translations of these documents becomes paramount. This article delves into the critical role of Tax Documents UK translation services, elucidating the intricacies involved in ensuring compliance with Her Majesty’s Revenue and Customs (HMRC) regulations. From common tax documents frequently required for translation to the nuances of cultural differences in financial language, we explore the multifaceted nature of this essential service. Additionally, we highlight the importance of certified translations and provide strategic insights for effective cross-language communication. Companies will benefit from understanding the steps to take when engaging with specialized Tax Documents UK translation services, as evidenced by case studies that underscore their integral role in facilitating successful global business operations.

- Understanding the Necessity of Professional Tax Documents Translation for UK Businesses

- Overview of Common UK Tax Documents Frequently Translated

- The Role of Accurate Translation in Compliance with HMRC Regulations

- Identifying Reliable and Specialized Tax Documents UK Translation Services

- The Importance of Certified Translations for Legal and Official Use

- Strategies for Effective Communication Across Languages with Tax Documents

- Navigating Cultural Nuances in Financial Documentation Translation

- Steps to Take When Engaging with UK Tax Documents Translation Services

- Case Studies: Successful Tax Document Translations that Facilitated Global Business Operations

Understanding the Necessity of Professional Tax Documents Translation for UK Businesses

UK businesses operating in a global context often encounter the need to translate tax documents for compliance with foreign regulations or to communicate financial information with international stakeholders. Professional translation services specializing in UK tax documents are indispensable in this scenario. These services not only ensure linguistic accuracy but also adhere to the specific terminologies and legal nuances inherent in tax documentation. The intricacies of fiscal legislation vary significantly across countries, and a mistranslation can lead to costly mistakes or non-compliance with tax laws. By leveraging the expertise of seasoned translators who are well-versed in both the source and target languages as well as the nuances of UK tax law, businesses can navigate this complex field with greater confidence. This not only facilitates clear communication but also safeguards against legal pitfalls that could arise from misinterpretation or miscommunication. In a world where tax regulations are intricate and multifaceted, the precision provided by professional UK translation services is a critical asset for any business with international interests.

The accuracy of financial data in its translated form is paramount, especially when it comes to tax documents. Professional UK tax document translators are trained to handle sensitive fiscal information with discretion and professionalism. They apply their expertise to convert complex tax documentation into accurate and understandable translations, ensuring that the integrity of the original content is maintained. This level of precision is crucial for UK businesses looking to expand globally or engage with international partners who require clear and precise financial reports. By choosing reputable translation services, companies can rest assured that their tax documents will be translated in a manner that complies with both UK accounting standards and the expectations of the target audience, thereby avoiding potential misunderstandings and legal complications associated with tax reporting.

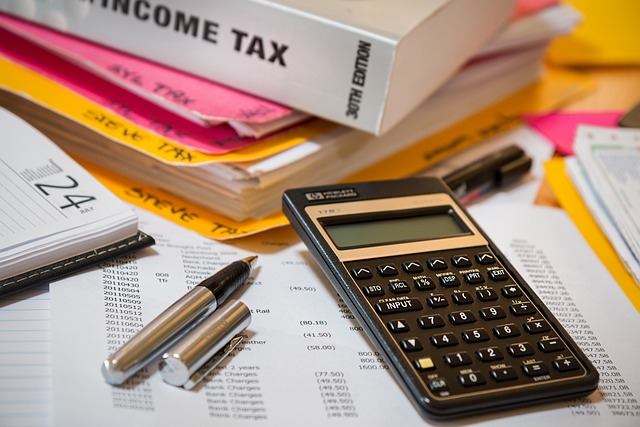

Overview of Common UK Tax Documents Frequently Translated

navigating the complexities of UK tax documents often necessitates professional translation services to ensure accuracy and compliance with international regulations. Common UK tax documents that are frequently translated include the Self-Assessment Tax Return, which provides a detailed overview of an individual’s or company’s income, allowances, and deductions. This document is crucial for individuals with diverse sources of income, such as self-employment, investment profits, and rental properties. Another frequently translated document is the Corporation Tax Computation, which outlines a company’s taxable profits and expenses. It is vital for businesses operating internationally to have this document accurately translated to align with financial reporting standards in different jurisdictions. Additionally, VAT returns, PAYE forms, and HMRC letters are also commonly requested for translation. These documents pertain to various aspects of UK taxation, including value-added tax obligations, income tax withholding, and communication from the UK tax authorities. Professionally certified translators with expertise in tax and accounting jargon are indispensable in this context, as they can provide precise and legally binding translations that meet both the linguistic and technical requirements of the target language and audience. Utilizing professional UK translation services ensures that all tax-related documentation is accurately conveyed, facilitating efficient cross-border transactions, compliance with legal obligations, and effective communication between entities.

The Role of Accurate Translation in Compliance with HMRC Regulations

When navigating the complexities of UK tax documents, precision in translation is paramount. Professional UK translation services play a pivotal role in ensuring that financial information is accurately conveyed across languages. Tax Documents UK, specifically designed for multilingual entities and individuals dealing with Her Majesty’s Revenue and Customs (HMRC), must be translated without ambiguity to maintain compliance. The nuances of tax law are inherently complex; a mistranslation can lead to misinterpretation of regulations, resulting in legal complications or financial penalties. Thus, it is imperative to engage services that employ native-speaking experts well-versed in both the target language and the technicalities of UK tax legislation. These professionals are adept at capturing the subtleties and specificities within tax documents, thereby facilitating accurate reporting and adherence to HMRC regulations for businesses and individuals alike. This level of accuracy not only safeguards against legal pitfalls but also supports transparent international trade and communication, ensuring that all parties involved have a clear understanding of their fiscal obligations.

Identifying Reliable and Specialized Tax Documents UK Translation Services

When the need arises to translate UK tax documents, precision and expertise are paramount. Professionals dealing with such sensitive material must possess a deep understanding of both the linguistic nuances and the intricate details of UK tax legislation. Reliable translation services specializing in tax documents from the UK not only ensure accuracy in figures and terminologies but also maintain the confidentiality and integrity of the financial data being conveyed. These services are staffed by translators who are often native speakers, equipped with accounting knowledge and proficiency in legal language, thereby bridging the communication gap between different jurisdictions effectively. It is crucial to select a service provider that has a proven track record in handling such documents; one that offers certification of translations where necessary and adheres to industry-standard quality controls. By choosing a specialized UK translation service for your tax documents, you guarantee that your financial obligations are understood and fulfilled accurately across borders, mitigating the risk of errors or misinterpretations that could have significant legal and fiscal consequences.

The Importance of Certified Translations for Legal and Official Use

When engaging with tax documents in the UK, precision and accuracy are paramount. For legal and official purposes, translating tax documents requires a level of expertise that goes beyond basic linguistic proficiency. Certified translations, provided by professional UK translation services, ensure that all numerical values and financial terminologies are accurately conveyed across languages. This certification verifies the translated content’s authenticity and reliability, which is crucial for compliance with legal standards and regulatory bodies. In instances where tax documents need to be submitted to foreign jurisdictions or used in cross-border transactions, certified translations act as a bridge between legal systems, facilitating seamless communication and adherence to international requirements. Opting for services that specialize in UK tax document translation guarantees not only linguistic correctness but also the necessary certifications that validate the translated text’s integrity, essential for official use and legal proceedings.

Strategies for Effective Communication Across Languages with Tax Documents

When navigating the complexities of UK tax documents, professional translation services play a pivotal role in ensuring clarity and accuracy across languages. Effective communication is paramount when dealing with tax-related matters, as even minor misinterpretations can lead to significant financial implications or compliance issues. To facilitate seamless cross-lingual understanding, it’s essential to engage with UK translation services that specialize in the financial sector. These experts are well-versed in the nuances of tax legislation and terminology, which is critical for maintaining the integrity of the information being conveyed.

Choosing a reputable UK tax documents translation service can mitigate the risks associated with language barriers. Such services employ translators with expertise not only in linguistics but also in accounting principles and legal standards relevant to the UK tax system. This dual proficiency ensures that all figures, terms, and conditions are accurately translated and interpreted, bridging the gap between different languages while maintaining the precision required for compliance and decision-making. With professional UK translation services, businesses and individuals can confidently navigate international transactions and reporting requirements, knowing that their tax documents have been conveyed with the utmost clarity and precision.

Navigating Cultural Nuances in Financial Documentation Translation

When venturing into the realm of translating UK tax documents for international audiences, professional translation services must navigate the intricate tapestry of linguistic and cultural nuances inherent in financial documentation. The UK’s unique terminology and legal jargon present challenges that extend beyond mere word-for-word translation. A precise understanding of tax laws and their implications is crucial to accurately convey the intended meaning across different languages. Translation services specialising in this field must possess a deep familiarity with both the source and target languages, as well as the cultural contexts they inhabit. This ensures that the translated documents maintain their original intent and comply with legal standards, which is paramount for tax documents UK companies often require when engaging with global markets.

Moreover, the translator’s role extends beyond linguistic equivalence to encompass an understanding of the cultural nuances that can alter the meaning of financial texts. For instance, what is considered a routine deduction in the UK may not have a direct equivalent in another country, necessitating explanatory notes or adjustments to maintain clarity and accuracy. In this context, tax documents UK translation services must employ expert linguists who are adept at bridging cultural gaps, providing clients with translations that are not only accurate but also comprehensible to non-English speaking stakeholders. This level of expertise is indispensable for businesses looking to navigate international regulations and ensure their financial practices align with global standards.

Steps to Take When Engaging with UK Tax Documents Translation Services

When the need arises to translate UK tax documents, engaging with professional translation services is a prudent step to ensure accuracy and compliance with legal standards. The initial phase involves careful selection of a service provider with expertise in financial translations, particularly within the UK’s regulatory framework. It is imperative to verify the credibility of the service by checking their qualifications, experience, and client testimonials. Once a reputable service is identified, the next step is to provide them with detailed instructions specific to your tax documents. This includes specifying the type of document, its purpose, and any particular terminology or nuances relevant to UK tax law that must be accurately conveyed in the translation.

Effective communication with the translation service is key throughout the process. Clarify any ambiguous points and ascertain their turnaround time, especially if there are urgent deadlines. Confidentiality should also be a priority, as tax documents often contain sensitive financial information. Professional UK translation services worth their salt will offer confidentiality agreements to safeguard your data integrity. Additionally, they should employ native speakers with a strong grasp of both the source and target languages to ensure the translations are culturally appropriate and semantically precise. Before finalizing the service, it’s advisable to request a sample translation to assess their competence and attention to detail. This due diligence step can save time and resources by avoiding potential errors in your UK tax documents’ translations.

Case Studies: Successful Tax Document Translations that Facilitated Global Business Operations

UK businesses expanding their operations internationally often encounter the need for precise and accurate translations of tax documents to navigate foreign legal and financial landscapes effectively. A prime example of this is the case of a mid-sized UK manufacturing firm seeking entry into the German market. The company’s tax documents, including VAT returns and corporate tax forms, were meticulously translated by professional UK translation services, ensuring compliance with German tax regulations and facilitating seamless communication with local tax authorities. This allowed for timely market entry and the establishment of a subsidiary without the usual hiccups associated with language barriers in financial documentation.

Another case study involves a London-based tech startup that secured significant funding from investors in Japan. The start-up’s audited accounts and tax statements were professionally translated to provide Japanese stakeholders with a clear understanding of the company’s financial health. This transparent approach not only helped in fostering trust but also expedited due diligence processes, leading to a successful partnership that expanded the startup’s operations globally. These instances underscore the importance of leveraging UK translation services for tax documents, which can be pivotal in achieving business objectives across international borders.

In conclusion, navigating the complexities of tax documentation in a global marketplace necessitates precision and expertise. For UK businesses, employing professional tax documents translation services is not just beneficial but indispensable for seamless international operations. These specialized services ensure that every figure, term, and nuance in financial documentation is accurately conveyed, thereby facilitating compliance with Her Majesty’s Revenue and Customs (HMRC) regulations. By choosing reliable and specialized translation providers, businesses can confidently communicate across languages, leveraging the full potential of their tax documents to engage with stakeholders worldwide. The success stories highlighted in this article underscore the transformative impact that expert translations can have on global business strategies. In the dynamic landscape of international commerce, accurate UK tax document translations are a cornerstone of effective cross-border communication and legal compliance.