Navigating UK Tax Returns: The Essential Guide to Certified Translations and Services

For non-UK residents and those whose native language isn't English, it is imperative to obtain certified translations of tax documents for submission to Her Majesty's Revenue and Customs (HMRC) in the UK. The translation services used must…….

For non-UK residents and those whose native language isn't English, it is imperative to obtain certified translations of tax documents for submission to Her Majesty's Revenue and Customs (HMRC) in the UK. The translation services used must be professional and specialized in handling financial texts, with a focus on UK tax legislation to ensure accuracy and compliance. Certified translators affiliated with bodies like the Institute of Translation & Interpreting (ITI) or the Chartered Institute of Linguists (CIOL) provide the necessary expertise to translate Self Assessment forms, VAT returns, corporation tax reports, and other financial records accurately. These certified translations come with a statement of accuracy and contact details for the translator or agency, guaranteeing that the translated content is a true representation of the original documents. This process is vital to avoid errors, legal issues, and potential complications like audits. Utilizing reputable UK translation services not only streamlines tax submissions but also upholds legal and financial integrity, ensuring that your tax documents meet UK standards and are accepted by HMRC.

When non-UK residents hold assets or income sources within Britain, accurately translating financial records becomes paramount. This article elucidates the critical role of certified translations in complying with UK tax return requirements. We delve into the necessity of these translations, highlighting their distinction from standard translations and the importance of engaging professional UK translation services to ensure legal compliance. From understanding the legal framework that governs translated tax documents to selecting a trustworthy service provider, this guide provides a comprehensive overview of the process and considerations for individuals navigating the intersection of international finance and UK tax regulations.

- Understanding the Necessity of Certified Translations for UK Tax Returns

- The Role of Accredited Translation Services in Tax Documentation Compliance

- Key Differences Between Certified and Non-Certified Translations in a Tax Context

- Common Foreign Documents Needed for UK Tax Returns and Their Translation Requirements

- Steps to Obtain Certified Translations for Your UK Tax Return Submission

- The Legal Framework Governing Certified Translations for HMRC Purposes

- How to Choose the Right Translation Service for Your UK Tax Return Documents

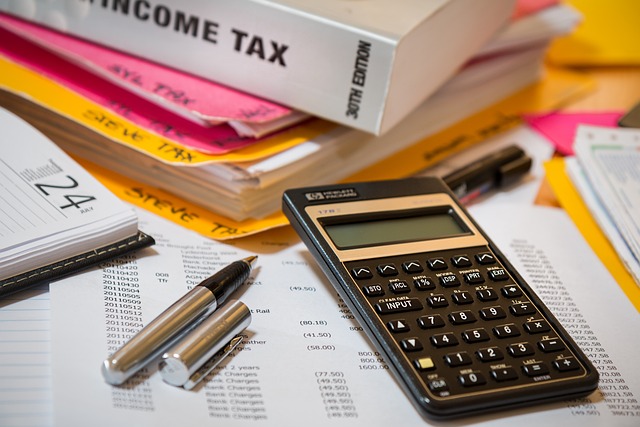

Understanding the Necessity of Certified Translations for UK Tax Returns

When non-UK residents or individuals who are not native English speakers need to submit tax documents to Her Majesty’s Revenue and Customs (HMRC) in the UK, it is imperative that all translated tax documents meet specific standards. The UK tax system requires precise translations of foreign language financial records, contracts, and other relevant tax documents to ensure accuracy and compliance with legal requirements. This is where professional UK translation services become indispensable. These services offer certified translations that are officially recognized by HMRC and other regulatory bodies. A certified translation includes a statement from the translator or translation agency affirming the accuracy of the document, along with their contact information. This certification verifies that the translated content is an authentic representation of the original documents. It is crucial to engage with reputable UK translation services to avoid discrepancies and potential legal complications. By providing HMRC with properly certified translations, taxpayers can navigate their fiscal obligations in the UK with confidence, ensuring all financial information is correctly conveyed and understood by the authorities. This not only facilitates a smooth tax submission process but also safeguards against any misrepresentation of income or assets that could lead to penalties or audits.

The Role of Accredited Translation Services in Tax Documentation Compliance

When it comes to ensuring the accuracy and compliance of tax documents in the UK, accredited translation services play a pivotal role. The UK’s tax documentation, including Self Assessment forms, VAT returns, and corporation tax reports, often contain complex terminology and numerical data that can be challenging for non-native speakers to translate precisely. Accredited translation services specialise in translating these documents accurately, ensuring that every figure, term, and nuance is correctly conveyed in the target language. This precision is not just a matter of communication; it’s integral to legal and financial integrity. Tax authorities within the UK require meticulous attention to detail, and any oversight can lead to delays or discrepancies that could potentially result in penalties or audits. By leveraging the expertise of professional translators who are well-versed in both language and tax legislation, businesses and individuals can navigate this complex process with confidence, knowing their tax documents comply with UK standards, thus upholding transparency and accountability in their financial dealings.

Key Differences Between Certified and Non-Certified Translations in a Tax Context

Common Foreign Documents Needed for UK Tax Returns and Their Translation Requirements

Steps to Obtain Certified Translations for Your UK Tax Return Submission

When submitting your UK tax return, it is imperative to ensure that all tax documents are accurately represented in English. If your original records are in another language, obtaining certified translations becomes a necessary step. Certified translation services in the UK specialise in translating financial and legal documents, including tax returns, accounts, and supporting documentation. To begin the process, you should first identify all the documents that require translation. These typically include foreign income statements, property rental income reports, foreign bank statements, and capital gains forms.

Once you have gathered these documents, select a reputable UK translation service that offers certified translations. Professional translators who are members of relevant associations, such as the Institute of Translation & Interpreting (ITI) or the Chartered Institute of Linguists (CIOL), will provide the highest quality translations. Ensure that the service you choose provides a certificate of accuracy alongside the translated documents. This certificate attests to the translation’s reliability and authenticity, which is crucial for tax authorities. Upon completion, the certified translations should be reviewed carefully to confirm that all figures, dates, and relevant information are accurately conveyed before submission with your UK tax return.

The Legal Framework Governing Certified Translations for HMRC Purposes

When individuals or businesses operating in the UK are required to submit tax documents, and these records are in a language other than English or Welsh, certified translations become necessary to comply with Her Majesty’s Revenue and Customs (HMRC) regulations. The legal framework governing certified translations for HMRC purposes is outlined in the Taxes Management Act 1970, which stipulates that all foreign-language tax documents must be accompanied by a certified translation to ensure accuracy and authenticity. HMRC accepts certified translations as long as they are provided by a professional translator who is accredited or recognized by a relevant body, such as the Institute of Translation and Interpreting (ITI), the Chartered Institute of Linguists (CIOL), or the Association of Translation Companies (ATC). These organizations uphold high standards of quality and integrity in translation services, ensuring that translations for tax documents meet the necessary legal criteria. UK translation services that offer certified translations will provide a statement of accuracy along with the translated document, confirming that it is a complete and faithful representation of the original content. This certification process not only facilitates compliance with UK tax laws but also helps in avoiding potential penalties or delays in tax return processing. It is imperative for individuals and entities to engage with professional translation services that can deliver HMRC-accepted certified translations, thereby ensuring the proper handling of tax documents within the legal framework set forth by the UK government.

How to Choose the Right Translation Service for Your UK Tax Return Documents

When your tax documents require translation for submission in the UK, selecting the right translation service is paramount to ensure accuracy and compliance with legal standards. Certified translations for UK tax returns must adhere to strict guidelines set by HM Revenue & Customs (HMRC). The chosen service should be proficient not only in the language of your documents but also well-versed in the nuances of UK tax law. Look for translation services that offer UK translation services, as they will be familiar with the specific terminologies and formats required by HMRC. These services typically provide a certified translator who can vouch for the translation’s accuracy and authenticity with a signed statement or certificate. This certification is crucial, as it proves to tax authorities that your foreign-language documents have been accurately translated and are ready for submission. Additionally, opt for a service with a strong track record and positive reviews, indicative of their expertise and reliability in handling sensitive financial information. By doing so, you minimise the risk of errors or misinterpretations that could lead to complications with your tax return process. Always verify that the translation agency is accredited and holds professional indemnity insurance for added peace of mind. With these considerations in place, you can confidently choose a translation service that will facilitate a seamless submission of your UK tax return documents.

When navigating the complexities of the UK tax system, especially for individuals or businesses with foreign income or assets, the necessity of precise and certified translations cannot be overstated. The UK’s tax documentation requirements demand accurate representations of all financial information, regardless of its original language. Accredited translation services play a pivotal role in ensuring that these documents meet HMRC’s stringent standards. Understanding the nuances between certified and non-certified translations within this context is paramount for compliance and legal standing. This article has outlined the critical aspects of this process, from identifying the necessary foreign documents to the selection of a reliable translation service, all within the framework of UK tax laws. By adhering to these guidelines, taxpayers can confidently fulfill their obligations with the utmost accuracy and clarity.