Precision Translations: Navigating UK Tax Documentation Requirements

Navigating UK taxation demands precise translations of tax forms, crucial for compliance and avoiding penalties. Tax Documents UK translation services specialize in this area, employing native-speaker linguists with financial expertise to handle comp…….

Navigating UK taxation demands precise translations of tax forms, crucial for compliance and avoiding penalties. Tax Documents UK translation services specialize in this area, employing native-speaker linguists with financial expertise to handle complex terminology. These services ensure accurate translations, maintain document structure, and comply with HMRC regulations, streamlining the process for individuals and businesses while preserving confidentiality. Choosing a reputable provider with rigorous quality assurance is vital for avoiding legal issues and ensuring sensitive data protection.

Ensuring accurate UK tax document translations is crucial for international businesses and individuals navigating complex tax systems. This comprehensive guide delves into the intricacies of UK tax documentation requirements, highlighting the significance of precise translations in avoiding compliance issues. We explore common challenges, from terminology nuances to cultural differences, and offer strategic advice on choosing reliable translation services. Additionally, we provide insights on quality assurance, legal considerations, and efficient tax document management tips for seamless operations. Discover how expert translation services can streamline your tax obligations.

- Understanding UK Tax Documentation Requirements

- The Importance of Accurate Translations

- Common Challenges in Tax Document Translation

- Choosing the Right Translation Service

- Quality Assurance for Tax-Related Documents

- Legal and Compliance Considerations

- Tips for Efficient Tax Document Management

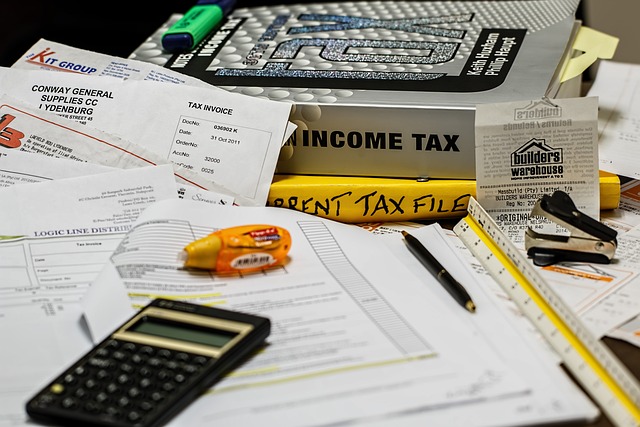

Understanding UK Tax Documentation Requirements

When it comes to navigating the complex world of UK taxation, understanding the documentation requirements is half the battle won. Tax documents in the UK can vary widely depending on the type of tax, whether it’s income tax, corporation tax, or value-added tax (VAT). Each has its own set of forms and guidelines that must be accurately completed and submitted to HM Revenue & Customs (HMRC).

For individuals and businesses requiring tax document translations in the UK, it’s crucial to opt for professional services. Tax Documents UK translation services should not only ensure accuracy but also adhere to the specific linguistic nuances required by HMRC. This is essential to avoid misunderstandings or penalties, as even minor errors can delay tax refunds or trigger investigations.

The Importance of Accurate Translations

When it comes to tax documents in the UK, accuracy is paramount. Mistranslations can lead to severe consequences, including legal issues, financial penalties, and even criminal charges. Tax authorities demand precision and clarity, making it crucial to engage professional translation services for documents like tax returns, audit reports, and company registrations.

Reliable UK tax document translation services employ native speakers with extensive knowledge of both the source and target languages, ensuring that every term is correctly interpreted and conveyed. This attention to detail helps individuals and businesses navigate complex tax regulations with confidence, fostering a compliant and stress-free environment for all.

Common Challenges in Tax Document Translation

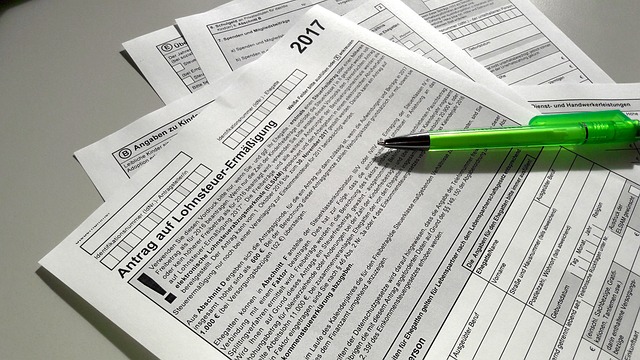

The process of translating tax documents requires a unique blend of language proficiency and an in-depth understanding of tax regulations, which can be challenging due to the highly technical nature of the content. One common hurdle is maintaining accuracy while ensuring that translated terms align with UK tax laws and practices. Tax terminology varies across languages, and what seems simple in one language might have complex equivalents or even different interpretations.

Another challenge lies in preserving the original document’s structure and format. Tax forms often include specific sections, boxes, and tables, which must be accurately reflected in the translation to avoid confusion. Professional UK tax document translation services employ linguists with expertise in both finance and taxation to mitigate these issues. They also utilize advanced tools and quality assurance processes to guarantee precise and compliant translations.

Choosing the Right Translation Service

When it comes to tax documents UK translation services, selecting the right partner is paramount. Look for a service that specialises in legal and financial translations, as these require precision and an understanding of technical jargon. Reputable firms will have experienced translators who are native speakers, ensuring accurate and contextually appropriate translations.

Check for quality guarantees, such as proofreading and editing checks, to maintain the integrity of your tax documents. Online reviews and case studies can provide insights into a company’s capabilities, especially when dealing with sensitive financial information. Ensure they comply with data protection regulations and offer secure file-sharing methods to protect your confidential materials.

Quality Assurance for Tax-Related Documents

When it comes to tax documents UK translation services, quality assurance is paramount. Accurate translations are essential for ensuring compliance with HMRC regulations and avoiding potential penalties. Reputable translation providers employ rigorous quality control measures, including multiple rounds of review by both machine and human translators, to catch any subtle nuances or errors that could impact the document’s integrity.

These processes go beyond simple word-for-word translation, delving into cultural relevance and tax terminology specificity. Inaccurate translations can lead to misinterpretations, causing delays in tax returns, audits, or even legal issues. Therefore, choosing a service with a proven track record of high-quality work is crucial when dealing with sensitive tax documents UK translation services.

Legal and Compliance Considerations

When availing of tax document translations in the UK, it’s imperative to consider legal and compliance aspects to ensure accuracy and avoid potential pitfalls. Tax documents often contain sensitive financial information, making translation services crucial for maintaining data integrity and confidentiality. The translator must possess a thorough understanding of UK tax laws, regulations, and accounting practices to deliver precise interpretations. This includes knowledge of specific terminology, reporting standards, and any unique requirements dictated by HMRC (Her Majesty’s Revenue and Customs).

Using professional translation services that specialise in tax documents ensures compliance with legal obligations and data protection laws. These services employ translators who are not only linguistically competent but also familiar with the UK tax system. They can accurately translate financial statements, tax returns, and other related documents while maintaining their integrity and confidentiality, thereby facilitating seamless international tax reporting and ensuring businesses meet their legal obligations efficiently.

Tips for Efficient Tax Document Management

Efficient tax document management is key for individuals and businesses in the UK, especially when dealing with international transactions or a diverse workforce. A well-organised system can significantly streamline the tax compliance process. One effective strategy is to implement a digital filing system, where all tax documents are stored electronically, making retrieval quick and secure. This method reduces the risk of misplacing paper documents and ensures easy access for both taxpayers and tax professionals.

Additionally, leveraging UK tax document translation services can greatly enhance efficiency. With the help of professional translators, you can accurately translate tax forms, statements, and contracts into various languages. This is particularly beneficial for multinational corporations or individuals with non-English speaking backgrounds, ensuring that all financial information is understandable and compliant across the board.

When it comes to navigating the complex landscape of UK tax documentation, accurate and timely translations are paramount. By understanding the specific requirements, leveraging the right translation services, and adhering to legal considerations, businesses can ensure their tax affairs remain in order. Efficient management of these documents not only simplifies compliance but also fosters a symbiotic relationship between international operations and the UK tax system. Relying on professional translation services specialised in tax documentation is key to avoiding errors, streamlining processes, and ultimately facilitating smoother financial reporting.