Professional Tax Document Translation: Navigating UK Regulations with Expert Services

In modern Britain, professional Tax Documents UK translation services are essential for navigating complex tax regulations and ensuring compliance. Accurate translations by experts in taxation terminology help individuals and businesses avoid penalti…….

In modern Britain, professional Tax Documents UK translation services are essential for navigating complex tax regulations and ensuring compliance. Accurate translations by experts in taxation terminology help individuals and businesses avoid penalties, manage finances efficiently, and facilitate international transactions. Choosing reliable services with native speakers and subject matter experts ensures quality, cultural adaptability, and adherence to HMRC rules. Advanced technologies like AI and cloud-based platforms further streamline the process, enhancing speed and cost-effectiveness for tax document translation in the UK.

In today’s global economy, navigating complex tax regulations requires clear communication. When dealing with UK tax documents, professional translation services are essential for accuracy and compliance. This comprehensive guide explores the critical aspects of translating tax documents in the UK, from understanding the importance to overcoming challenges, choosing the right service providers, ensuring quality, legal considerations, and future trends. Discover how top-tier translation services can streamline your tax obligations, offering peace of mind and avoiding potential pitfalls.

- Understanding the Importance of Professional Tax Document Translation in the UK

- Common Types of Tax Documents Requiring Translation

- Challenges and Complexities in UK Tax Document Translation

- Key Skills and Expertise for Accurate Tax Translations

- Choosing the Right UK Tax Translation Services

- The Process: From Initial Assessment to Final Delivery

- Ensuring Quality Assurance in Tax Document Translation

- Legal and Compliance Considerations for Translated Tax Documents

- Future Trends in UK Tax Document Translation Services

Understanding the Importance of Professional Tax Document Translation in the UK

In the dynamic, multicultural landscape of modern Britain, professional tax document translation plays a pivotal role for individuals and businesses alike. Accurate and reliable UK tax documents translations are essential for navigating complex tax regulations and ensuring compliance. Whether it’s for personal tax returns, business accounting, or international transactions, precise communication in both local and global languages is key to avoiding penalties and maximizing financial accuracy.

Choosing the right translation services for tax documents is crucial. Professionals with expertise in taxation terminology and legal nuances ensure that every detail is correctly interpreted and conveyed. This not only safeguards against errors but also facilitates a smoother process, allowing individuals and businesses to focus on their core activities while meeting their tax obligations efficiently.

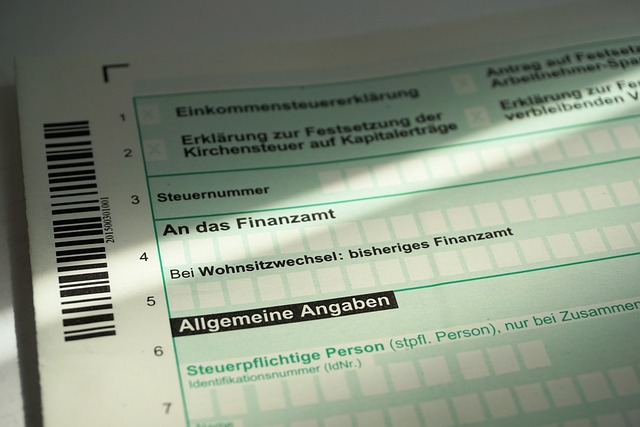

Common Types of Tax Documents Requiring Translation

In the complex landscape of UK taxation, various documents demand meticulous attention and often, professional translation services to ensure compliance. These tax documents can range from straightforward forms to intricate financial statements, each requiring accurate interpretation for international businesses and individuals. Common types include but are not limited to, P45/P60 Forms detailing an individual’s income and national insurance contributions, Corporation Tax returns, VAT registration and settlement documents, and European Union (EU) tax-related paperwork for those operating across borders.

Professional UK tax document translation services become indispensable when dealing with international clients or expanding into new markets. Accurate translations ensure that financial information is conveyed correctly, avoiding potential errors and penalties. These services cater to the specific language needs of diverse businesses, facilitating smooth navigation through the intricate web of UK taxation regulations.

Challenges and Complexities in UK Tax Document Translation

Key Skills and Expertise for Accurate Tax Translations

When it comes to tax documents UK translation services, accuracy is paramount. Professional translators must possess a unique blend of key skills and expertise to ensure that fiscal information is conveyed with precision and compliance. Core competencies include a deep understanding of both the source and target languages, as well as technical knowledge of tax terminology and concepts.

Proficiency in legal and financial jargon is essential, as are strong research abilities to stay up-to-date on regulatory changes. Cultural sensitivity is also critical, as tax systems vary widely globally. Translators must adapt to these nuances while maintaining the integrity of the original document’s meaning. Additionally, attention to detail and a meticulous approach are vital to avoid errors that could have significant financial implications.

Choosing the Right UK Tax Translation Services

When it comes to translating UK tax documents, selecting the right service is paramount. Look for companies that specialize in tax-related translations and possess a deep understanding of both the source and target languages, as well as local taxation laws and terminology. Professional services employ native speakers and subject matter experts who can accurately convey complex fiscal concepts without altering their meaning.

Choosing a reputable firm with a proven track record ensures your documents are handled by experienced professionals. They should offer various translation formats tailored to different tax authorities’ requirements. Additionally, opt for providers that prioritize security and confidentiality, especially when dealing with sensitive financial information.

The Process: From Initial Assessment to Final Delivery

When using professional UK tax document translation services, the process is meticulously structured to ensure accuracy and timely delivery. It begins with an initial assessment where our experts thoroughly review your documents, understanding their complexity and unique requirements. This step involves a detailed analysis of terms, terminology, and any industry-specific jargon to guarantee precise translations that meet legal standards.

Following this, our team of highly skilled translators embarks on the translation process, leveraging their expertise in tax-related terminology to deliver accurate, culturally adapted texts. Quality assurance checks are conducted at every stage, ensuring consistency and fluency in the final product. The translated documents are then prepared for delivery, formatted according to your preferences, and ready to be submitted, facilitating a seamless experience throughout.

Ensuring Quality Assurance in Tax Document Translation

When it comes to tax documents UK translation services, quality assurance is paramount. Professional translators must possess a deep understanding of both the source and target languages, as well as a keen knowledge of tax terminology specific to each jurisdiction. This ensures accuracy in translating complex financial information while adhering to legal and regulatory standards.

Reputable translation companies employ rigorous quality control measures. These include multiple rounds of review by expert linguists, fact-checking against original documents, and even client feedback loops. Such processes are vital for maintaining high-quality standards and minimizing errors that could have significant implications in the tax filing process.

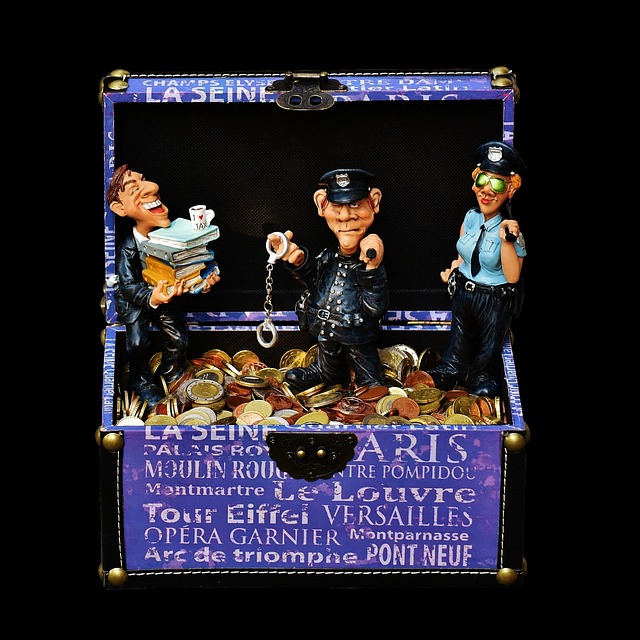

Legal and Compliance Considerations for Translated Tax Documents

When using UK tax documents translation services, it’s paramount to understand the legal and compliance considerations involved. Translated documents must adhere to strict standards to maintain the integrity of financial information. This includes ensuring accuracy in translating complex terms and concepts related to UK taxation laws. Any errors or misinterpretations could lead to serious legal and financial consequences for both the translator and the individual or organisation submitting the documents.

Compliance with regulatory bodies is crucial, as tax authorities scrutinise all submitted documents. Professional translation services should have a deep understanding of not only language but also local tax regulations. They must employ translators who are qualified, experienced, and up-to-date on any changes in tax legislation to guarantee that translated documents are both legally sound and compliant with UK tax laws.

Future Trends in UK Tax Document Translation Services

As technology advances, UK tax document translation services are expected to evolve significantly in the coming years. Artificial intelligence (AI) and machine learning will play a pivotal role in enhancing efficiency and accuracy. Automated tools can now handle initial drafts of translations, allowing human translators to focus on more complex linguistic nuances and ensuring consistency across multiple documents. This not only speeds up turnaround times but also reduces costs for businesses.

Additionally, the demand for specialized tax terminology translation is likely to increase as the UK’s economic landscape becomes more globalized. Translators will need to stay abreast of regulatory changes and industry-specific terminologies to provide precise interpretations. Cloud-based translation platforms and collaboration tools are also expected to gain traction, enabling real-time access and editing capabilities for clients and translators alike, further streamlining the entire translation process for tax documents in the UK.